Business managment

from a single app.

Product Catalog

Label, price, and organize products for a fast, simple checkout

Cash Acceptance

The CardPointe Mobile App also supports cash payments

Reporting Analytics

Filter and pull reports, plus void or refund transactions

Free Download

Compatible with iPhone and Android, the app is free to download from the Apple® App Store or Google Play™ .

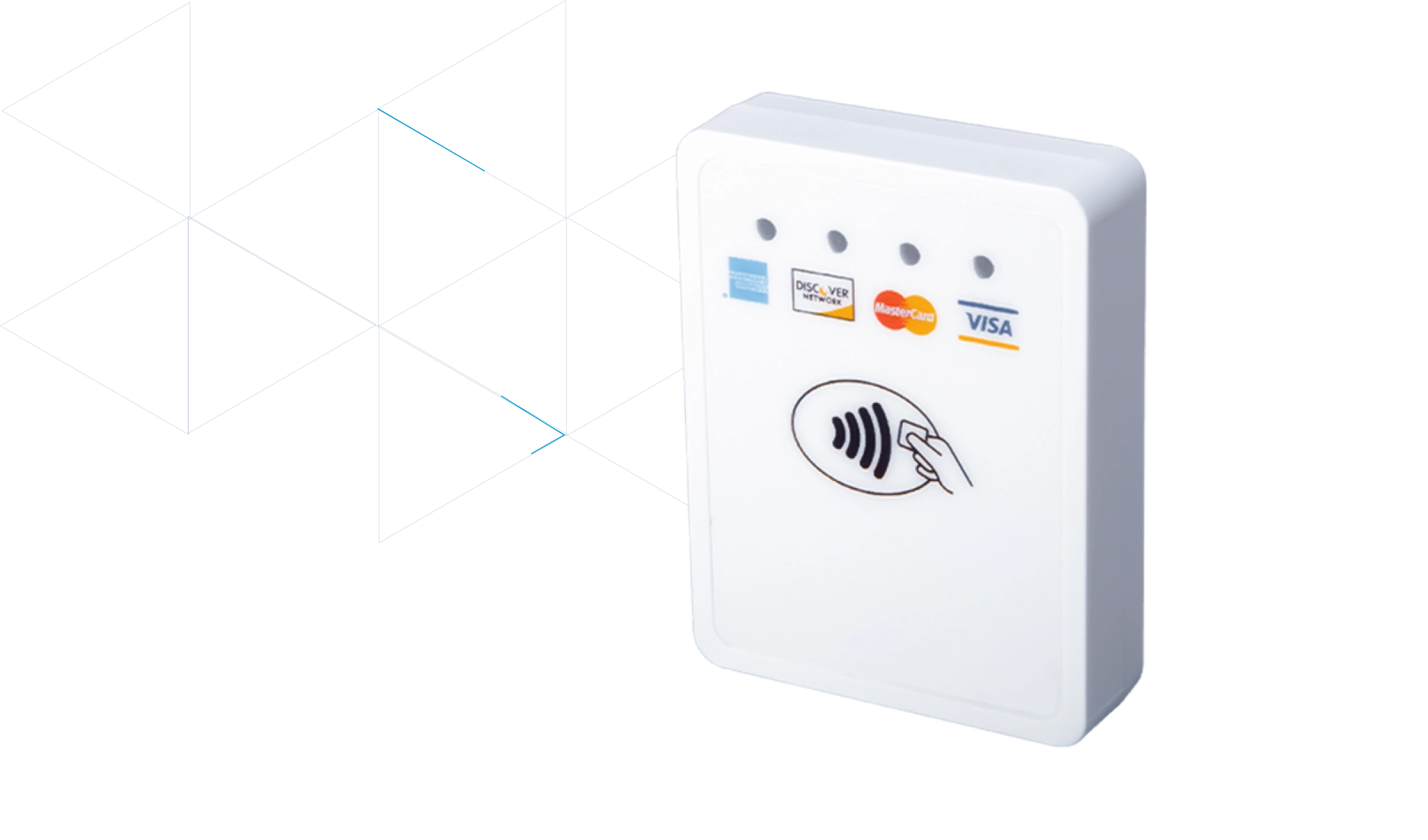

Accept card-present payments with a mobile credit card reader.

The CardPointe Mobile Credit Card Reader is portable and perfectly compatible with the CardPointe App, making it easy to securely accept credit cards directly from a smartphone or tablet.

Accept payments from anywhere.

Got questions? We got answers.

Contact Us

Your success in payments starts here! Please select your partnership type below so we can connect.